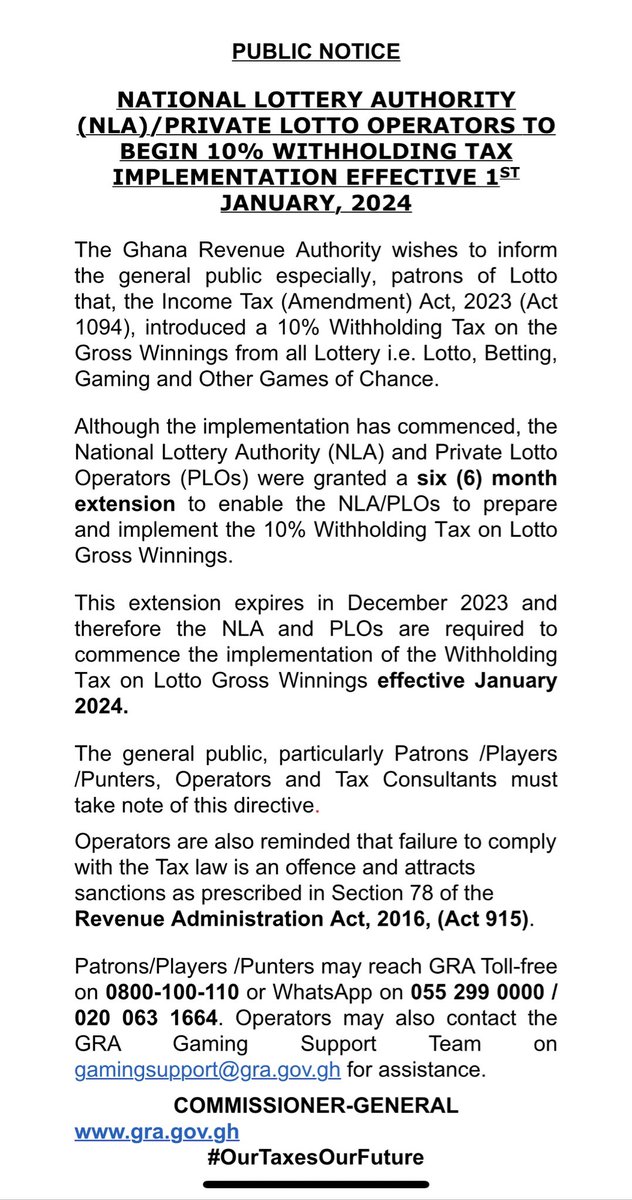

The Ghana Revenue Authority (GRA) has issued a notice to lotto patrons and operators, informing them that a 10% withholding on all gross winnings will be implemented starting from January 2024.

This development follows the government’s amendment of the Tax Act, introducing withholding tax on winnings from sports betting and lottery in August.

The Commissioner General of the GRA highlighted that the National Lottery Authority (NLA) and Private Lotto Operators (PLOs) had been granted a six-month extension, which is set to expire in December, despite the introduction of the 10% withholding tax earlier.

In a statement, the GRA emphasized, “The general public, particularly Patrons/Players Punters, Operators, and Tax Consultants must take note of this directive.”

It further reminded operators that non-compliance with the tax law is an offense and may result in sanctions as prescribed in Section 78 of the Revenue Administration Act, 2016 (Act 915).

The lottery and betting industries in Ghana have experienced significant growth in the past decade, attracting numerous betting companies to establish a presence in the country.

The announcement of the withholding tax has implications for both operators and patrons, marking a regulatory shift in the taxation of lottery winnings.